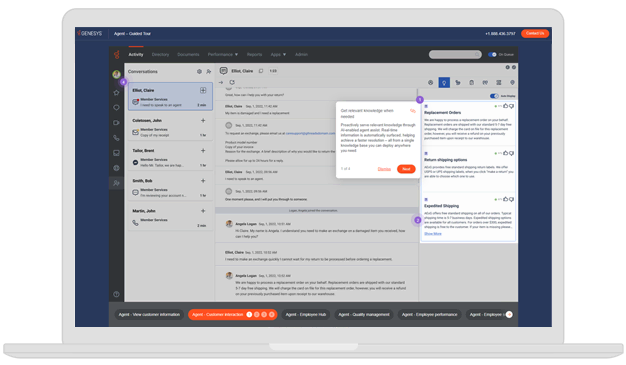

One management window

So far, Uplift has consolidated eight channels on Genesys Cloud — voice, SMS, email, chat, Trustpilot, Facebook, Instagram and Twitter. The first four are native channels, while Trustpilot is enabled via the Genesys Open Messaging API, and social channels through Genesys AppFoundry® Marketplace. All are managed from a unified user interface.

Integration with the company’s homegrown CRM system was another major advantage. Genesys recognizes a mobile number and pulls up the customer’s name and loan agreement in a flash, enabling agents to give a personal greeting and build rapport — a simple service enhancement that wasn’t possible before.

“Volumes haven’t really altered, but the way we do business has,” said Vining. “Before, there was no IVR — just basic routing and voice recording. And we couldn’t rely on our data. Now, we’re able to deflect calls, consistently meet our SLAs and have life-changing APIs that connect all our tools and data.”

Adapting easily with apps and automation

The company has made good use of Genesys AppFoundry. “I plug in so many applications and absolutely love AppFoundry,” said Vining. “Along with our Pypestream bot, we use a partner for satisfaction surveys, dashboards from Brightmetrics and knowledge management with Shelf.”

Built with Pypestream conversational AI, a digital assistant powered by natural language processing successfully resolves many general inquiries. After confirming whether they’d prefer to be served in English, Spanish or French, the customer can choose to speak to an agent or continue using the digital assistant. If the latter, they receive a text message and click on a link, transferring from a call to a self-service chat where they can update their details, make a payment or get fast answers to FAQs.