IRS Publication 1075 (Pub 1075) outlines security and privacy requirements for organizations handling federal tax information (FTI). It sets strict controls to ensure data confidentiality, integrity and availability.

That means any state and local agency that receives, processes or stores FTI — including, but not limited to agencies such as: Departments of Revenue and Taxation, Departments of Labor and Unemployment and Departments of Welfare and Child Protective Services— must comply with Pub 1075 to avoid legal and financial penalties.

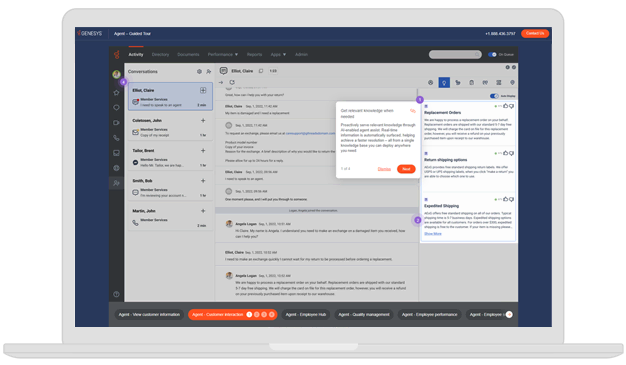

Join Government Technology and our partners at Genesys and Amazon Web Services (AWS) for a valuable webinar on meeting compliance and safeguarding taxpayer information.

This webinar covers:

- Meeting compliance for IRS audits to avoid financial penalties or even loss of federal funding

- Understanding your agency requirements in compliance and managing risk

- Why FedRAMP is essential to meet stringent federal security standards — especially for cloud-based platforms

- Success stories and best practices from other state and local agencies

Compliance with Pub 1075 lets you protect sensitive taxpayer data, reduce your risk of breaches and avoid financial penalties from the federal government. Don’t be caught off guard!