Your Genesys Blog Subscription has been confirmed!

Please add genesys@email.genesys.com to your safe sender list to ensure you receive the weekly blog notifications.

Subscribe to our free newsletter and get blog updates in your inbox

Don't Show This Again.

The human voice is the most powerful tool, yet we still feel its unheard when spoken. In the words of Julian Treasure, a notable sound consultant, “We spend roughly 60% of our communication time listening, but end up retaining only 25% of it.” When we apply this to customer experience in banking, the retention of communication data, and reciprocative responses to customer communication by banking support systems, is questionable.

The tone of voice and intent recognition are innate qualities on which humans rely to make conversations meaningful and to conduct mutually beneficial business. Greeting customers by their names to offering personalized financial advice are two examples of getting customers’ attention. Our brains are wired to listen and filter beneficial information while discounting the irrelevant as noise.

Here are some stats on typical customer experience in banking expectations, including customers’ preferred channels of communication.

Banks recognize that adopting customer service technologies and communication channels is imperative to meet the goals of customer satisfaction and company cost-effectiveness. Higher customer satisfaction can be achieved faster when most commonly asked questions and queries are executed by digital agents on voice and chat, using natural language processing and machine learning. Live agents can address complex inquiries.

In the past, digital banking solutions assumed that the customer had the knowledge and patience to make the right choices along their digital banking journey. Now, with most customers seeking instant gratification because of genuine time constraints or cultural preferences, there’s neither a beginning nor an end to the customer journey. This is glaringly due to an intermittent or lack of continuous customer engagement.

With millennials, Generation Z and the iGeneration fervently mutating communicative languages using slangs, emojis and other abbreviations — customer experience in banking must be differentiated so it continues to increase their customer lifetime value and bottom line.

A well-designed conversational artificial intelligence (AI) platform frees up customer support personnel by up to 20%. And that enables them to respond to more complex problems that are best resolved through human interactions. This adds to value creation by 80%.

The best bots today offer hyper-personalization with a thorough familiar voice and text-based user interfaces to enable a two-way digital experience and conversation. The keys to success are:

Getting Your First Quick Win and Showing ROI

Banks have struggled to balance old-fashioned personalized services with the cost of using use human agents exclusively. Therefore, conversational banking can provide a path to reduce the cost to serve.

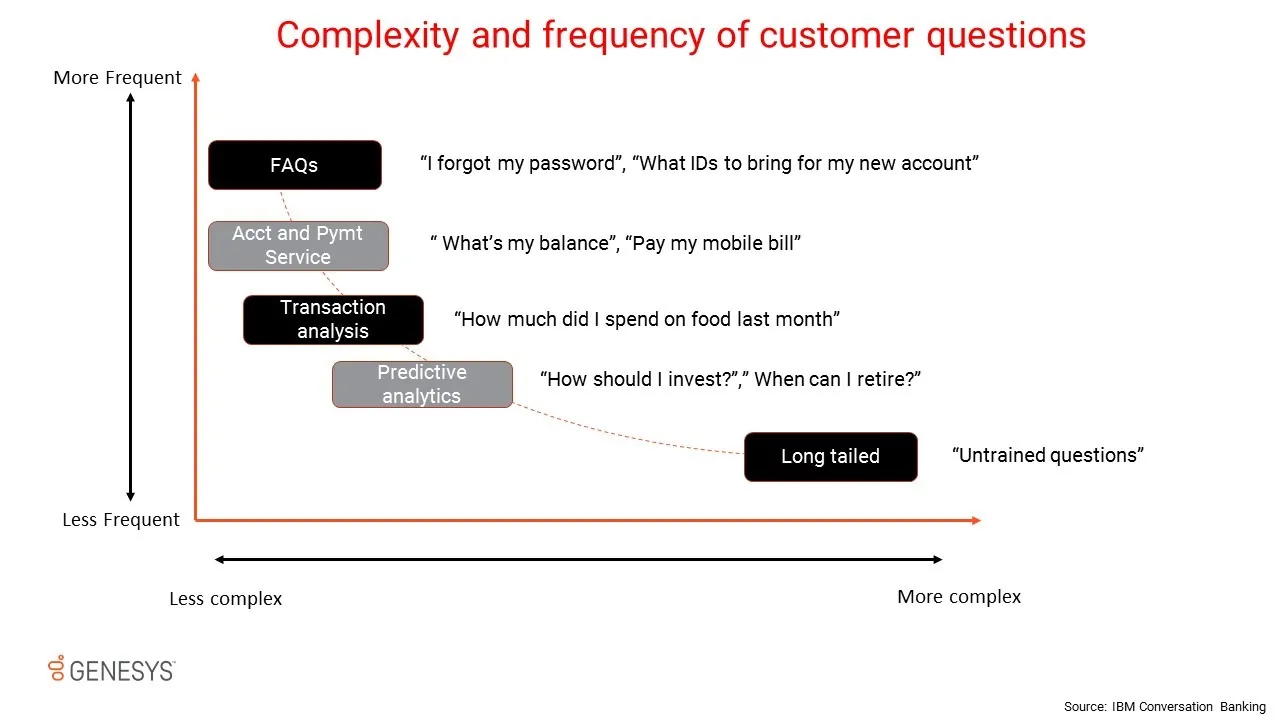

Banks would have to leverage existing customer data for previous interactions until they build their analytical and cognitive abilities to take complex inquiries. This includes segregating existing customer data sets based on complexity and frequency of the questions asked.

Account and payment services: After converting FAQs into chatbots, banks can provide simple services for accounts and payments, such as “What is my balance?” and “Pay my mobile bill.”

Simple financial advice: Customers appreciate if their banks behave like their financial advisors — giving them information on spending patterns. This requires that banks have access to historical insights that would help answer simple questions like, “How much did I spend on online purchases last month?”

Predictive analytics: The most advanced use cases require predictive analytics and financial planning algorithms. In these instances, customers want a human to provide the advice. So a human might take over the bot conversation. An example of this would be, “What is the best investment plan for me?”

Complex queries: These are the questions for which chatbots haven’t been trained. These queries are answered with cognitive search abilities through unstructured data. Humans are still the best resource for these questions.

Prepare to start your journey toward offering AI-based self-service.

Subscribe to our free newsletter and get blog updates in your inbox.