Your Genesys Blog Subscription has been confirmed!

Please add genesys@email.genesys.com to your safe sender list to ensure you receive the weekly blog notifications.

Subscribe to our free newsletter and get blog updates in your inbox

Don't Show This Again.

The insurance industry’s current messaging to consumers focuses on price. Along with that is an attempt to pivot toward innovation and customer centricity. Insurers that successfully improve the customer experience will see benefits, such as lower claims and administration costs as well as increased retention rates.

But this shift is a challenging one. Only 15% of consumers worldwide believe insurers provide exceptional experiences — ranking among the worst performing industries. Research also reveals an empathy gap in the insurance industry’s customer experience. This should be a concern for an industry where the product is effectively a promise that’s built on trust and empathy. Consumers want to feel heard and understood, and they crave clarity, personalization and simplicity along their end-to-end journeys. This is how they view empathy — and a lack thereof.

To meet these expectations, Property and Casualty, Health, and Life Insurance providers must better understand which moments matter most to their customers. And they need to define an optimal experience in those moments. Based on a survey of 3,500 consumers worldwide, Genesys research shows how consumers define quality experiences and where those experiences are falling short.

This is creating an empathy gap, specifically in three areas of the insurance industry customer experience: a lack of clarity around insurance products and their value; claims processes that feel opaque and burdensome; and rushed and impersonal renewal processes. Improving each of those areas gives insurance providers an opportunity to create effortless journeys that make customers feel valued.

Here’s how:

Transparency is critical for building a customer’s confidence and trust. Consumers want to understand their options and select coverage best suited to their circumstances.

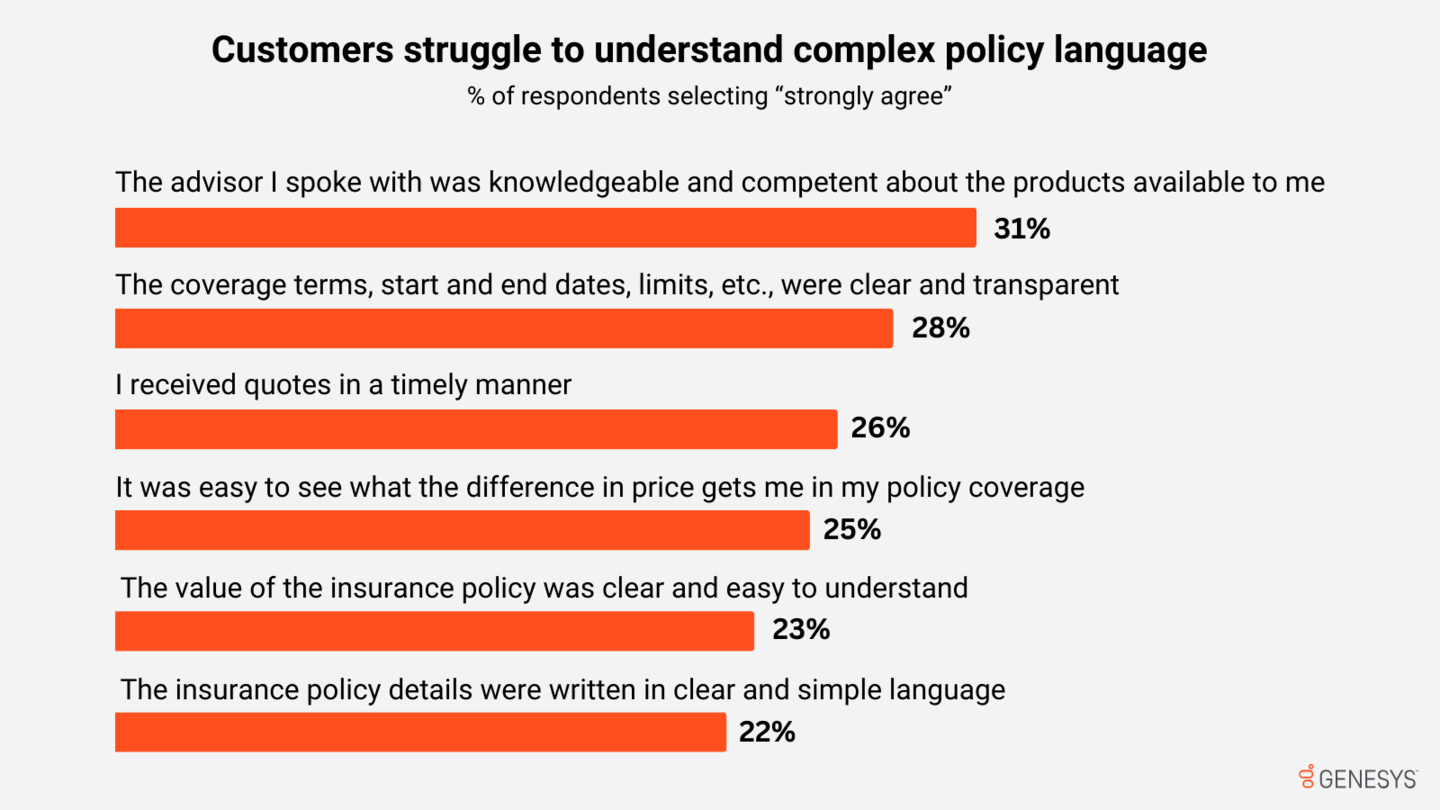

Consumers say the most important factors related to quotes, for example, are that advisors are competent, coverage options are clear and transparent, and quotes are timely. In fact, 70% expect to receive a quote within one day.

But there’s a gap in the experiences they’re receiving. Although many customers were satisfied with their experience when they interacted with an advisor, only 22% thought their policy details were clear. And only one-quarter thought it was easy to compare insurance products and services.

This lack of certainty creates an unstable foundation for the rest of the customer’s relationship with the insurance provider.

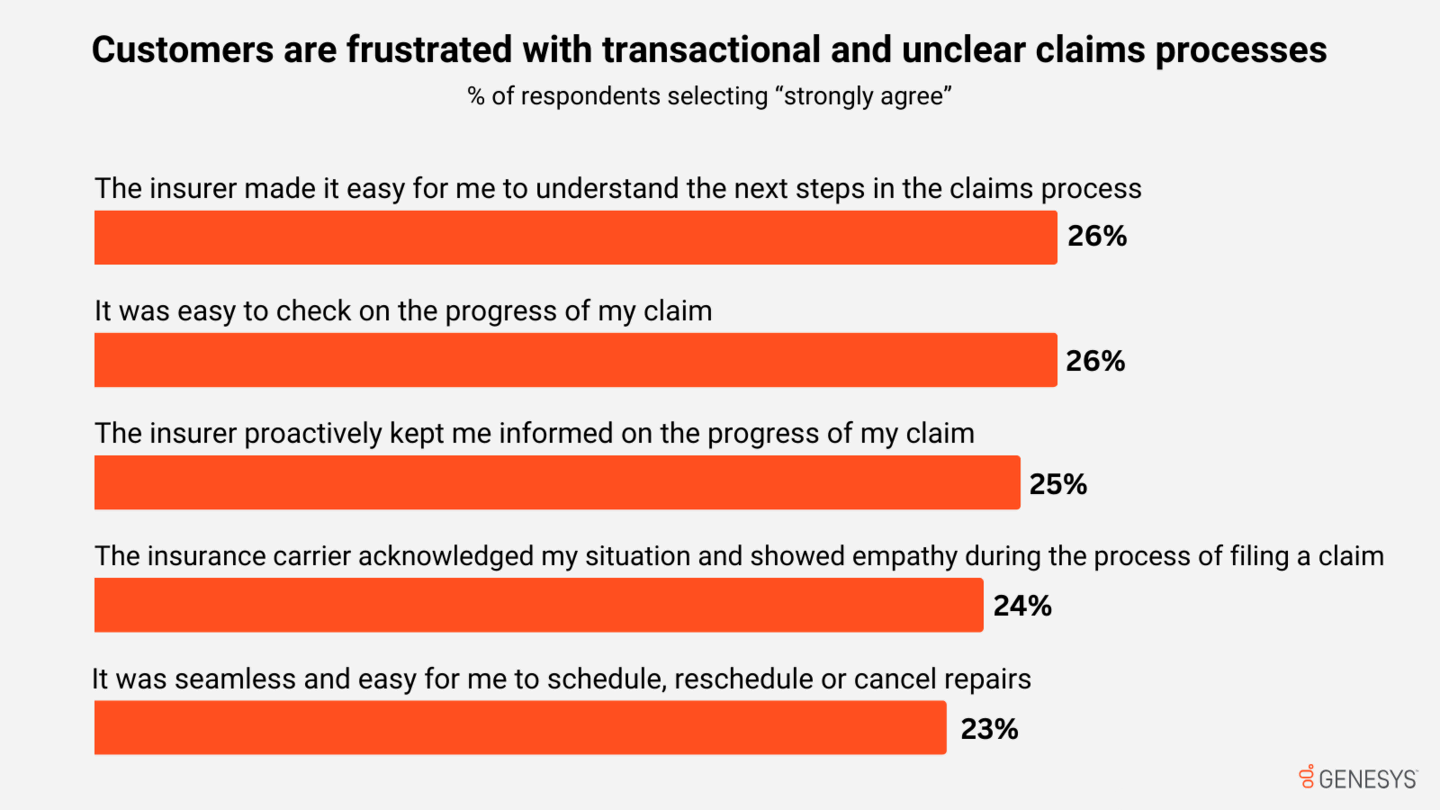

Other than pricing, claims have the biggest impact on whether a customer will renew their policy. When a customer needs to submit a claim, they value understanding next steps, easy access to status and proactive updates from their insurer. However, just one-quarter of survey respondents strongly agree that their insurer provides these.

Empathy also is lacking during the claims process. Less than 25% of insurance customers felt their provider acknowledged their situation and showed empathy during the claim-filing process. By providing frustrating claims experiences — where customers take the burden of driving the process forward and pursuing information — insurance companies damage the customer loyalty that impacts renewal rates.

To improve customer satisfaction, efficiency and cost, insurers should embrace automation and self-service in their claims processes. Communicating proactively can reduce customer effort while decreasing inbound status calls. A move toward real-time risk management would lead to claim prevention and lowers an insurer’s claims ratio.

When it’s time to renew a policy, customers have a strong expectation to understand any changes — and why they’ve been made. But just 26% of insurance customers surveyed strongly agree that they received a policy renewal alert that gives them enough time to comprehend and compare their current policy and new offerings.

Only one in four customers strongly agree their new policy terms were easy to understand. And almost a third say that their insurance company didn’t provide a comparison of their policies before and after.

Clear, proactive communication is an essential customer retention strategy. Recent Bain research found that, when insurance customers have positive experiences, they’re much less likely to switch providers. Insurers need to develop a complete view of the customer and be able to engage proactively through the channel of the customer’s choosing — providing the right information at the right time.

Organizations across every industry are competing on customer experience and raising the bar for all businesses. To stay competitive and improve the bottom line, insurance providers must close the empathy gap that complexity and uncertainty create.

It’s time for insurers to shift to a customer journey approach that enables them to close that gap. By implementing connected technology, measurement and management, insurance providers can orchestrate and optimize customer experiences in real time. This approach requires cloud-based technologies; automation; and AI to connect and coordinate channels, data, employees, interactions, knowledge and systems.

At a time when 77% of consumers will leave a brand after five or fewer poor interactions, offering empathetic end-to-end customer experiences is a solution that will improve satisfaction, reduce churn — and enhance business outcomes.

To learn more, read the full report “The insurance industry’s empathy gap.”

Subscribe to our free newsletter and get blog updates in your inbox.

Related capabilities: