Your Genesys Blog Subscription has been confirmed!

Please add genesys@email.genesys.com to your safe sender list to ensure you receive the weekly blog notifications.

Subscribe to our free newsletter and get blog updates in your inbox

Don't Show This Again.

“Would you like fries with that?” The simple, well-known question asked at fast-food giant McDonald’s is classic example of cross-selling. Many major enterprises rely on up-sell and cross-sell opportunities to increase revenue and generate profits. In fact, almost three quarters of salespeople who up-sell and 74% who cross-sell say that it drives up to 30% of their revenue, according to a 2022 HubSpot survey.

Yet most marketing budgets continue to focus heavily on new customer acquisitions at the expense of driving up-sell/cross-sell and retention of existing customers.

In this post, we’ll:

Up-sell and cross-sell are often confused and used interchangeably. But there’s a meaningful difference between the two.

An up-sell is when you encourage your customer to buy a higher-priced alternative of the current consideration. Up-selling encourages customers to purchase a more expensive model in the same product or service family, or to augment the original purchase with additional features like warranties.

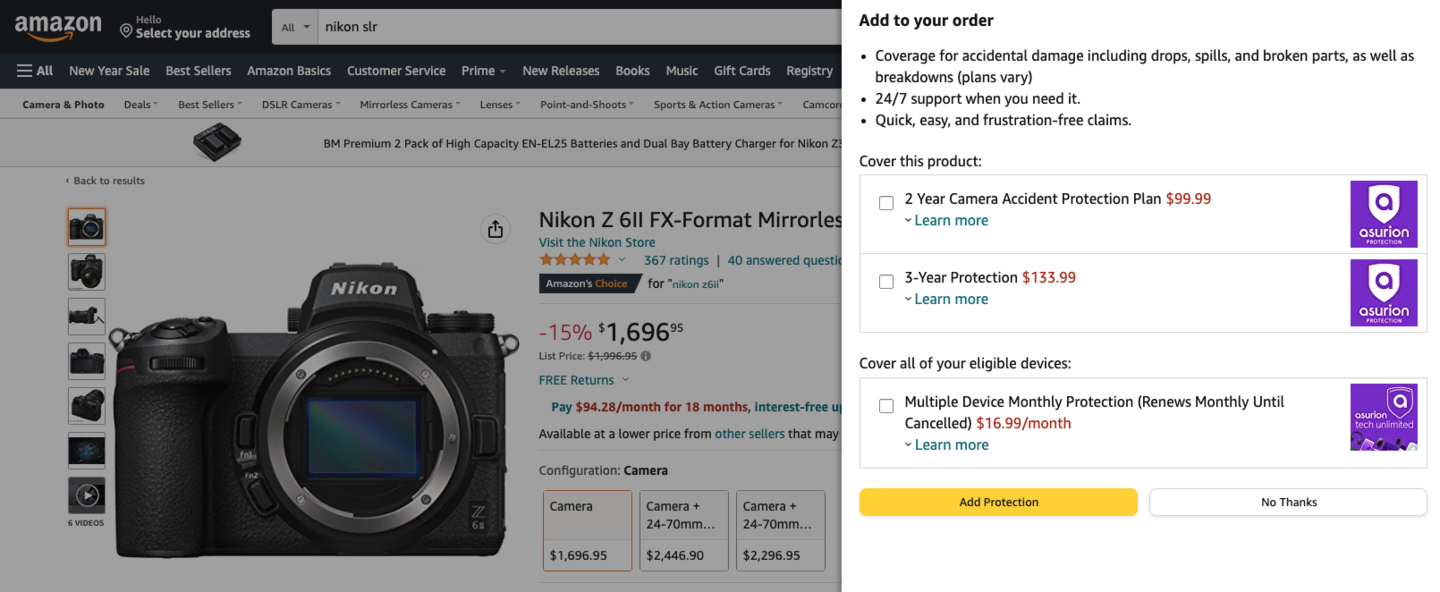

A familiar example is when retailers suggest consumers add a protection plan to their purchase, as shown below.

A cross-sell is when you recommend a product that complements your customer’s existing purchase but it’s from a different category. In this case, the retailer in the previous example offers a complementary product to the one already chosen.

Cross-selling identifies products and services that satisfy additional, complementary needs that are unfulfilled by the original purchase. A common example in retail banking is when your bank sends an offer for you to apply for a credit card after you open a new checking account.

Cross-selling and up-selling are closely related because they both focus on providing additional value to customers, rather than limiting them to products they’ve already considered or purchased. The key to success in both is to understand what your customers value most and then respond at the right time — and through the optimal channel — with products and services that truly meet those needs.

Lead generation is expensive. It’s far easier and more profitable to up-sell or cross-sell an existing customer than it is to make a new sale to a brand-new customer.

According to a KeyBanc survey of over 350 SaaS companies, new logo acquisition devours an average of $1.13 in customer acquisition costs for every dollar of revenue generated. Up-selling and cross-selling, on the other hand, cost an average of 27 cents.

Up-selling and cross-selling aren’t just sales and marketing tactics to make more money for a company. When done correctly, they help a customer derive more value out of their purchases, do their jobs better and make their lives easier. And up-selling and cross-selling generate more opportunities to provide good customer experiences and build deeper, stronger customer relationships. A well-chosen and well-timed up-sell or cross-sell can even convey empathy by addressing a customer need or desire.

Up-selling and cross-selling are great ways to increase your customers’ profitability over time and keep them coming back for more.

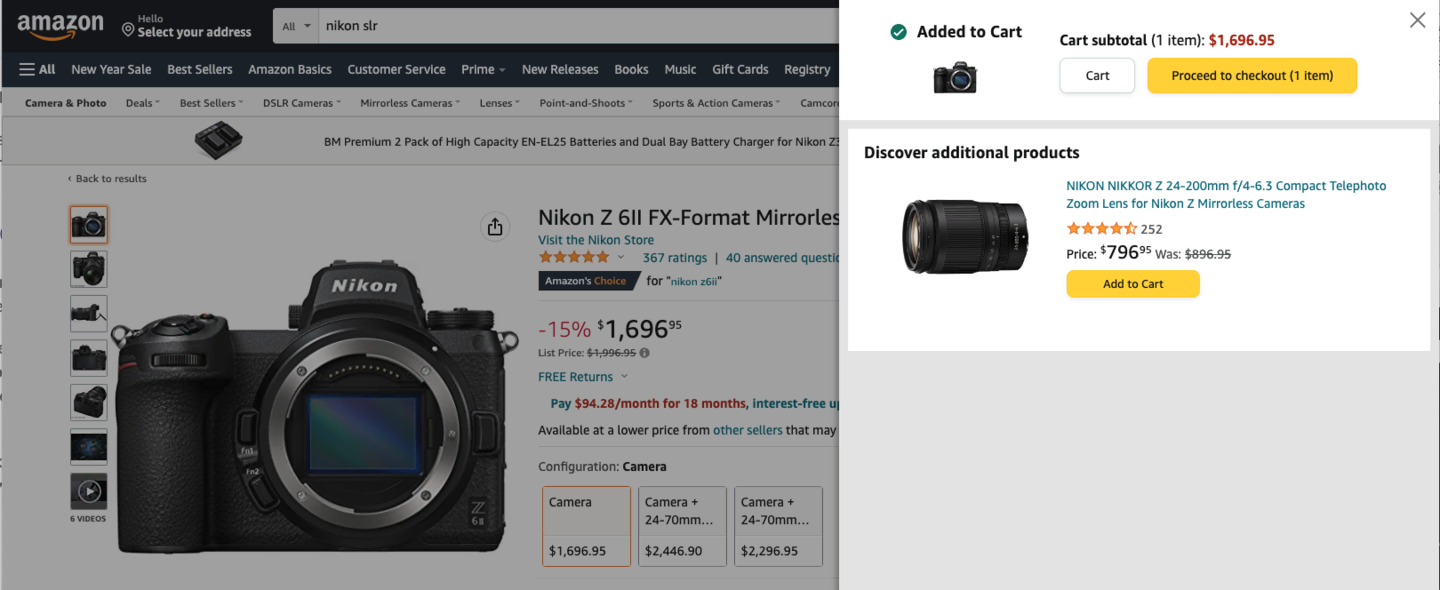

Marketing and customer service teams at retail and hospitality brands often are tasked with increasing up-sell conversions. By collaborating with their analytics team, they can leverage customer journey analytics software like Pointillist® to understand cross-channel behaviour and identify leading indicators of customers who are more likely to convert on an up-sell offer.

A hotel and resort company, for example, can analyse the results of several up-sell offers. In the example below, they find that adding a loyalty program point bonus increases their up-sell rate from 9% to 23%, compared to their standard dining and spa packages.

The team can also analyse upgrade rates based on a variety of customer attributes, including age and the number of stays per year.

They can share this information with their marketing team and orchestrate the experience so future customers with this behaviour will be automatically presented with the best up-sell offer when they book their reservation.

1. Take an Omnichannel View of Customer Experience

Your customers engage with different touchpoints throughout their journeys and likely take multiple journeys concurrently. To make cross-sell and up-sell offers that will have a high win rate, even as customers hop across channels and devices, you need a comprehensive view of each customer’s experience across all touchpoints.

For example, a quarter of UK households switched at least one communication service in the past 12 months, while more than one in 10 households made changes to their communications service packages, according to a recent Ofcom report. Convincing just a small percentage of those customers to add another telecom service to an existing package would make a meaningful impact on any telcos revenue and profitability.

To execute on opportunities like this, customer experience (CX) leaders are reorganising their businesses around omnichannel journeys by adopting new approaches like customer journey management.

The first and most important step in finding new up-sell and cross-sell opportunities is to take a journey-based approach. By continuously managing and measuring journeys, teams across the enterprise can better understand the customer’s likes, interests, behaviour and, most importantly, their goals.

Customer journey analytics gives companies the power to analyse millions of unique customer interactions across channels like web, voice, mobile, email and more, as well as over time. This approach enables you to orchestrate actions like up-sell or cross-sell offers when it’s most relevant to a customer and helps fulfill their goal.

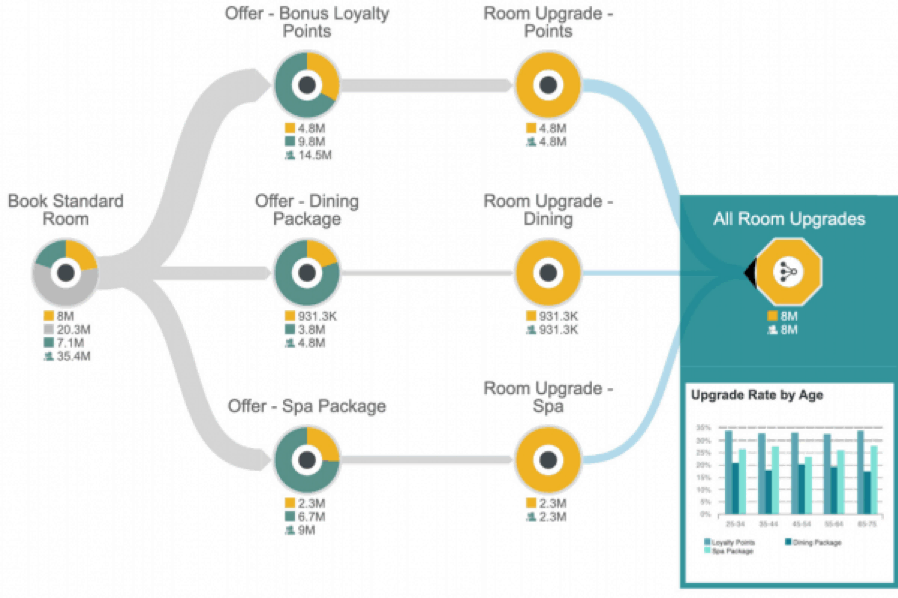

Using a journey-based approach to cross-sell and upsell analytics enables a leading retail bank to increase credit card conversions in the following journey analytics use case.

The credit card team at a major retail bank is tasked with increasing the percentage of the bank’s clients who also have a credit card from that bank. To understand the role different channels play in credit card offers and their respective efficiencies, the bank turns to customer journey analytics software.

The team uncovers a variety of paths across online and offline channels, such as branch visits, website browsing, mobile data, email data and in-app interactions that lead customers to view a credit card offer.

Within minutes, they discover how many customers go on to apply for a card online vs. how many reject or ignore the offer. With one click, they can see how many customers move forward at each step, how many drop out and how many are still present at that step.

Using customer journey analytics, the bank determines the offer converts better for people who see it as an email rather than as a text message or within the bank’s mobile app. Based on this information, they decide to send a personalised email offer to those who view the credit card offer and then abandon their journeys.

A few days later, the credit card team reviews the results and are delighted to see a large number of the email offers have been converted into new credit card applications. Next, the team orchestrates the experience by automatically adding anyone abandoning this journey in the future to the new email campaign.

This multichannel analysis would have taken days and consumed high-level data science resources to accomplish using traditional analytics approaches. Using journey analytics software, the credit card team can quickly find, analyse and deploy a solution with minimal support.

2. View All Customer Data Within the Context of Each Customer’s Experience

For many companies, data and organisational silos prevent them from interacting with customers in a way that reflects their unique context. They’re forced to rely only on the most recent interactions in a limited amount of channels to make decisions on cross-sell and up-sell offers.

A customer journey analytics solution that’s supported by a journey data hub gives you a single, unified view of the customer. It quickly integrates all of your customer data across a variety of systems and channels, such as point-of-sale systems, email marketing platforms, marketing automation systems, data warehouses, websites, surveys, call centres, clickstream and chat.

In addition to simply integrating data across touchpoints and internal systems, a customer journey data hub uses identity resolution to determine which events in each system are actually being performed by the same individual.

To improve cross-sell and up-sell, you can incorporate data like:

Having this data at every step along the customer journey will significantly increase the success of a cross-sell/up-sell campaign.

3. Create Dynamic Customer Segments Based on Behaviour

Behavioural segmentation is a powerful approach to drive growth and expansion through cross-sell and up-sell. Companies like Amazon use machine learning algorithms that take customer behaviour data — a user’s purchase history, items in their shopping cart, and items they’ve previously rated and liked — and make product recommendations. Consumers expect similar experiences from other retailers, as well as their telecom providers, banks and even health insurers.

Internal and external data that spans several years can be combined to build dynamic customer profiles. Knowing how the customer’s product use has changed over time, how she’s migrated among different products and which factors caused change in behaviour are all valuable in designing effective share-of-wallet strategies.

Customer behaviour data can also be used to determine when not to target some customers for an offer. For instance, if a customer has had a recent negative experience with your company or the customer isn’t getting enough value from products they’ve already purchased, it’s probably not a good idea to make them a fresh offer.

There are four profiles of customers you should avoid cross-selling or up-selling to as they may be unprofitable for the business:

Service Demanders. This customer segment often overuses customer service channels and tends to call support for every issue they encounter, often ignoring service announcements. When service demanders purchase more products, your support costs rise disproportionally.

Revenue Reversers. This segment gives the appearance of generating revenue, but then take it back as they’re more likely to return items, default on payments or terminate contracts early. The more they buy, the more they display such behaviour — and that costs your company time and money.

Promotion Maximisers. This segment gravitates toward steep discounts, making them unprofitable for the company overall.

Spending Limiters. This segment has a small, fixed budget that they likely won’t exceed with a company. If they buy additional products, they likely won’t increase their total spending with your company. Therefore, the money you spent in cross-selling to them wasn’t recovered as they didn’t generate any additional revenue.

To identify these unprofitable customer segments, you have to mine behaviour data and track each customer’s end-to-end journey, so you can make dynamic cross-sell and up-sell decisions that are efficient and profitable in the long run.

4. Use Predictive Analytics to Provide New Product Recommendations

Customer journey data can be used to predict each customer’s likelihood of responding to a cross-sell or up-sell offer. Input data can include the products and services that are commonly purchased and used in conjunction with one another. You can further analyse this data to identify which customers bought, as well as the dates when purchases were made.

This knowledge is valuable for the product marketing team to create product and pricing bundles. These product recommendations are also valuable to customer support teams who can make real-time cross-sell or up-sell suggestions based on each customer’s specific situation.

Hyatt Hotels has aligned its operations across 500 hotels globally to use predictive analytics for cross-selling and up-selling. Hyatt used guest history and preferences from their membership program to identify guests with similar profiles and create customised offers for each based on a unique combination of amenities, room upgrade or activity packages.

The program worked by prompting front desk agents with relevant and timely messages such as, “Based on what we know, this person will want a room with an ocean view” or “This person will likely be looking for a spa package.”

Using predictive analytics for cross-selling and up-selling, Hyatt increased the average incremental room revenue post reservation by 60%, compared to similar programs in the past that didn’t use sophisticated analytics.

The hotel industry isn’t the only industry that’s rich with customer data. When stitched together throughout the customer journey, this data allows brands to move past basic audience attributes and discover more specific and relevant attributes for better engagement and personalised service offerings. The most common barrier to getting and implementing real-time insights is that the data lives in silos in disparate systems such as property management system (PMS), point-of-sale (POS), central reservation system (CRS), call centre, spa, food and beverage departments, etc.

In most cases, this data isn’t consolidated with the rest of the hotel’s online data from web analytics, guest satisfaction surveys and social media.

Customer journey data management platforms integrate data from different sources into one central platform that sits as an intelligence layer with existing technology stack. In this way, customer journey analytics generates insights for marketers and customer experience teams alike.

5. Execute and Measure Cross-sell and Up-Sell Campaigns in Real Time

Customers expect personalised, relevant information and offers driven by their preferences, recent interactions, and latest product and support experiences. And they’ll abandon their journeys after a single poor experience. Companies can’t afford to falter or provide a sub-par interaction at any step along the customer journey.

To improve the performance of cross-sell and up-sell campaigns, marketers must be able to make the most relevant offer to the most potentially profitable person — at the most opportune time — via the most appropriate channel.

Experience orchestration solutions enable organisations teams to do just that. Teams can activate audiences and orchestrate campaigns based on customer behaviour, such as customers who’ve converted in the past or those who’ve dropped out at a particular point in the journey.

With the explosion in customer data collection and breakthrough technologies like machine learning and customer journey analytics, it’s the perfect time to give cross-selling and up-selling the attention and focus they deserve.

By taking a journey-based, data-driven approach, customer-centric enterprises can ensure up-sell and cross-sell offers aren’t sent to achieve only an internal marketing goal. They can be sure the offers they make will be timely and well received, so both customers and the business will more easily achieve their goals.

Subscribe to our free newsletter and get the Genesys blog updates in your inbox.